- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

As Tesla Kicks Off Cybertruck Sales in Qatar, Should You Buy, Sell, or Hold TSLA Stock?

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock(1).jpg)

It's not every day that a company rewrites the rules of the road, but Tesla (TSLA) seems to have made a habit of it. The electric vehicle (EV) giant has now rolled into Qatar, marking yet another milestone in its relentless march across the globe. As of Oct. 3, the Tesla Cybertruck — the angular beast that looks like it rolled straight out of a sci-fi movie — has officially hit Qatar roads.

The move follows Tesla’s earlier debut in Saudi Arabia, where it showcased the Cybertruck alongside a refreshed Model Y. This seems to be a calculated pit stop in the heart of oil country. Since first entering the United Arab Emirates (UAE) back in 2017, Tesla has gradually set the stage for this expansion.

It's a power play aimed at fueling growth while its home markets hit speed bumps. In Europe, Chinese EVs like BYD Company (BYDDY) and Zeekr Intelligent Technology (ZK) are snapping at Tesla’s heels. Meanwhile, in the United States, demand is expected to sputter after the $7,500 federal EV tax credit faded away in September.

Yet, beneath the shiny announcements lies a bigger question of momentum. Tesla’s third-quarter deliveries were solid, thanks to last-minute buyers chasing that tax credit. But with the U.S. market cooling, could the Middle East just be the new growth engine Tesla needs?

About Tesla Stock

Tesla has grown into a global powerhouse in electric vehicles and sustainable energy solutions. Headquartered in Austin, Texas, it commands a market capitalization of approximately $1.37 trillion.

The company’s reach spans from EVs and solar energy products to battery storage systems that power homes and even industrial grids. Tesla's blend of manufacturing, direct sales, financing, and an ever-growing Supercharger network gives the company a moat that few can cross.

On Wall Street, TSLA stock is the market’s equivalent of a rollercoaster. In the past 52 weeks, shares have surged 73%, leaving the broader S&P 500 Index’s ($SPX) 13% gain in the dust.

Currently, TSLA shares trade at 378 times forward adjusted earnings and 14.82 times sales. These figures sit well above the industry averages and their own five-year average multiples, showing that investors are betting big on Tesla’s long game.

Tesla Misses on Q2 Earnings

When Tesla rolled out its Q2 2025 financials on July 23, it was not exactly a showstopper. The much-anticipated numbers landed with a thud, missing the Street's mark on both the top and bottom lines. Total revenue slipped 12% year-over-year (YOY) to $22.5 billion, missing analysts’ expectations of $22.7 billion.

Automotive revenue — Tesla’s bread and butter — took a sharper hit, down 16% to $16.7 billion. That marked two straight quarters of falling sales, with total deliveries plunging 13.5% to 384,122 units. Non-GAAP net income fell 23% to $1.4 billion, while non-GAAP EPS dropped 23% to $0.40, short of the Street’s anticipated $0.43.

Yet, anyone who has followed CEO Elon Musk knows that he does not flinch easily. Musk had previously warned of a bumpy road ahead, and here it is. The expiration of the $7,500 EV tax credit, the removal of emissions penalties, and tariffs carved a dent across Tesla’s automotive and energy divisions.

The Q3 delivery report revealed a 2% YOY jump to a record 497,099 units. However, TSLA stock veered off course, slipping more than 5% on Oct 2.

The Street remains cautious. Analysts expect Q3 EPS to tumble 34% YOY to $0.41, with Tesla’s full fiscal 2025 bottom line projected to decline 43% to $1.16. But if history has taught investors anything, it's that Tesla does not stall for long. The consensus for fiscal 2026 points to a powerful rebound of 68% to EPS of $1.95.

What Do Analysts Expect for Tesla Stock?

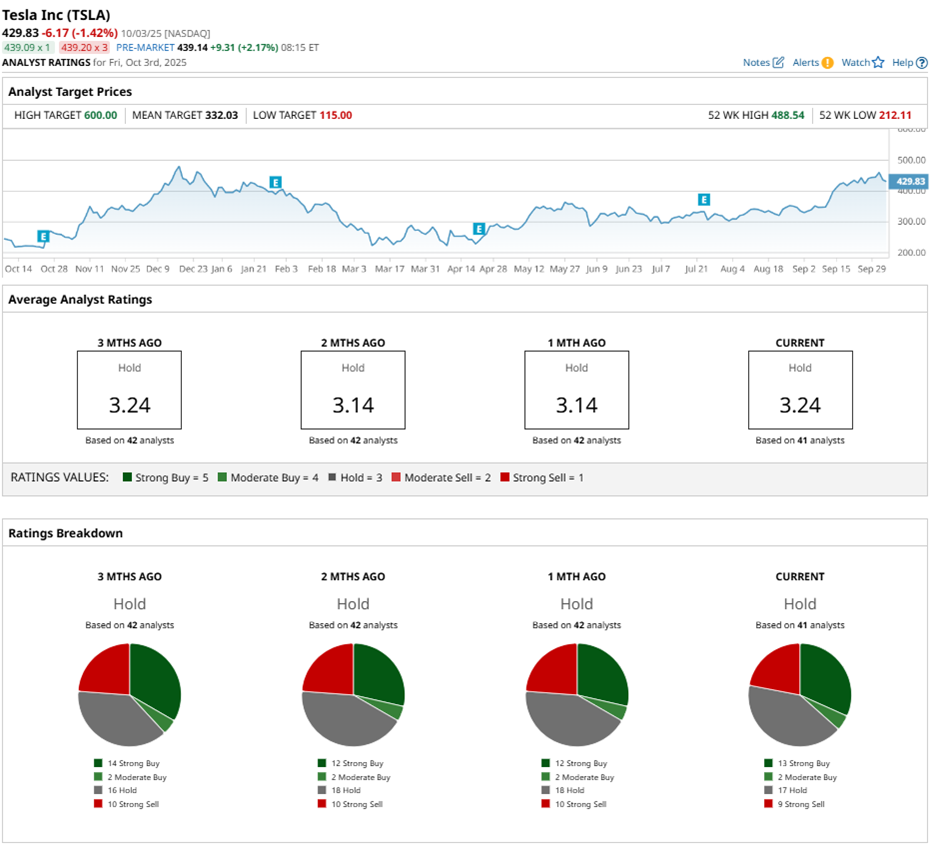

Wall Street’s view on TSLA stock could best be described as cautiously dazzled. TSLA stock carries an overall “Hold” consensus rating. Out of 42 analysts covering the stock, 13 rate it a “Strong Buy,” two call it a “Moderate Buy,” 17 suggest “Hold,” and 10 think it's time to bail with a “Strong Sell" rating.

Yet, the numbers tell another story. Shares have already zipped past the average price target of $340. Some analysts, however, are stepping on the gas. Analyst George Gianarikas of Canaccord Genuity stands firmly in the bull camp with a “Buy” rating and a $490 price target.

Baird analyst Ben Kallo has gone one better, upgrading TSLA from “Neutral” to “Outperform” and hiking his price target of $548. Finally, there’s Wedbush analyst Dan Ives, who recently cranked up his target to a Street-high $600 while keeping a “Buy” rating. That lofty price target implies potential upside of 45% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.