- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Zimmer Biomet Earnings Preview: What to Expect

/Zimmer%20Biomet%20Holdings%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg)

With a market cap of $18.8 billion, Zimmer Biomet Holdings, Inc. (ZBH) is a global medical technology company that designs, manufactures, and markets innovative orthopedic reconstructive products, sports medicine solutions, biologics, and surgical technologies. The company serves healthcare professionals worldwide with advanced products that treat disorders and injuries of bones, joints, and soft tissues.

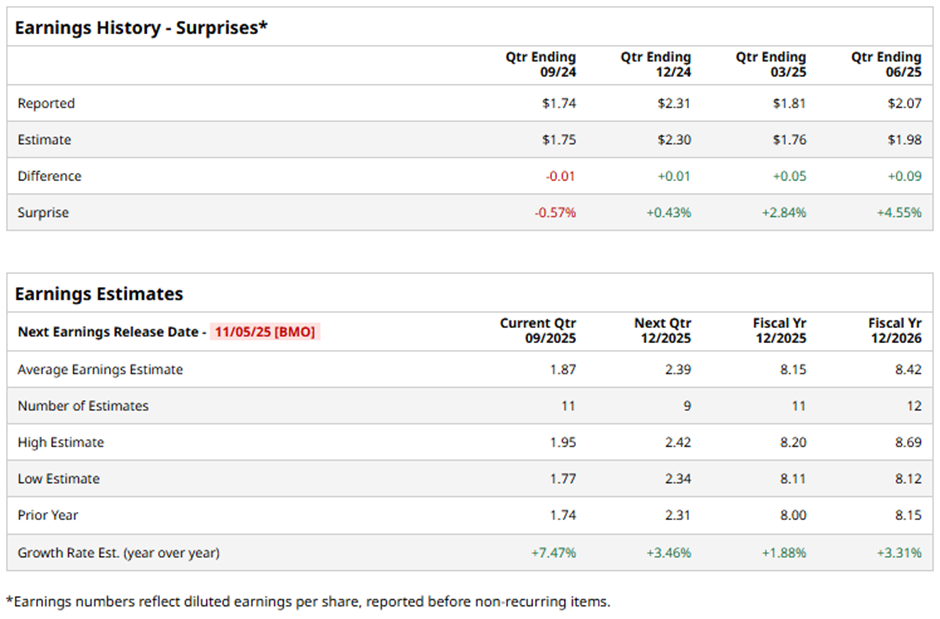

The Warsaw, Indiana-based company is slated to announce its fiscal Q3 2025 results before the market opens on Wednesday, Nov. 5. Ahead of the event, analysts expect Zimmer Biomet to report an adjusted EPS of $1.87, up 7.5% from $1.74 in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in three of the past four quarterly reports while missing on another occasion.

For fiscal 2025, analysts predict the medical device maker to report adjusted EPS of $8.15, a 1.9% rise from $8 in fiscal 2024. Looking forward, adjusted EPS is projected to grow 3.3% year-over-year to $8.42 in fiscal 2026.

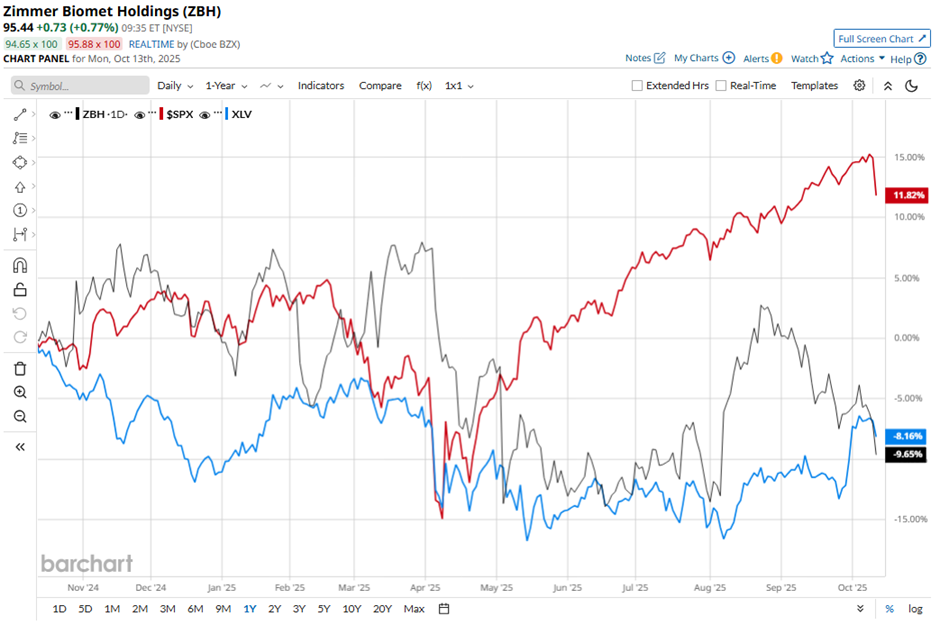

Shares of Zimmer Biomet have fallen 7.9% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 13.4% increase and the Health Care Select Sector SPDR Fund's (XLV) 7.6% decline over the same period.

Shares of Zimmer Biomet climbed nearly 8% on Aug. 7 after the company reported better-than-expected Q2 2025 results, posting adjusted EPS of $2.07 and revenue of $2.08 billion. Investor sentiment was further boosted as the company raised its 2025 adjusted EPS forecast to $8.10 - $8.30, well above analyst estimates. Additionally, management cut its expected tariff headwinds to about $40 million.

Analysts' consensus rating on ZBH stock is moderately optimistic, with an overall "Moderate Buy" rating. Among 27 analysts covering the stock, eight recommend a "Strong Buy,” two have a "Moderate Buy" rating, 15 give a "Hold" rating, and two have a "Strong Sell.” The average analyst price target for Zimmer Biomet is $110.74, indicating a potential upside of 16% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.